The article CRM for tax advisors: optimizing client management, deadline control and digital collaboration first appeared in the online magazine BASIC thinking. With our newsletter UPDATE you can start the day well informed every morning.

Today, clients expect more than just correct tax returns: They want transparent communication, quick feedback and smooth collaboration – preferably digital and uncomplicated. For tax advisors, this means: If you want to retain clients in the long term, reliably meet deadlines and survive in competition, you have to modernize your own processes. This is exactly where a CRM like HubSpot to. The platform supports law firms in rethinking client management, deadline control and teamwork – and noticeably easing the burden on everyday practice.

Typical challenges in everyday office life

In the In the everyday life of tax advisors, many processes run in parallel: new client inquiries, ongoing cases, deadlines, document management and team coordination. Without a central solution, information quickly gets mixed up, tasks are overlooked and service quality suffers.

Common problems without CRM:

- Client data is distributed across different systems

- Deadlines and tasks are not reliably tracked

- Communication with clients is unstructured and difficult to understand

- Documents and emails are difficult to find

What a CRM has to do for tax advisors

Modern CRM software for tax advisors should offer the following functions:

- Central client management: All clients, contacts, files and communication histories are clearly stored in one place.

- Efficient deadline and task management: The CRM reminds you of important appointments, tax return deadlines and tasks so that nothing is forgotten.

- Document management: Contracts, tax documents and emails are stored directly with the client or case and can be quickly found.

- Automated communication: Follow-ups, reminders and client information are sent automatically and personalized.

- Digital collaboration: Tasks can be distributed, commented on and tracked within the team. Clients can exchange documents securely via portals or email.

- Reporting and evaluation: Dashboards provide insights into client development, deadline status and team utilization.

- GDPR compliance: Data protection, consent management and access rights are documented in a legally secure manner.

Practical: This is how HubSpot supports tax advisors in their everyday lives

With the platform of HubSpot tax firms can do theirs Completely digitally map client and deadline control. New inquiries are automatically accepted into the system, qualified and assigned to the correct contact person. The team can see at a glance which clients have outstanding concerns, which deadlines are pending and which tasks still need to be completed.

Example of a typical workflow:

- A potential client fills out a contact form on the law firm website.

- The CRM creates a new contact and automatically assigns it to a tax advisor or team.

- The system sends a personalized confirmation of receipt and automatically schedules a callback or consultation appointment.

- Documents, notes and emails can be stored centrally at the client.

- Deadlines and tasks are created automatically and the team receives a reminder in a timely manner.

Client management and digital collaboration: Everything at a glance

The CRM software from HubSpot enables tax advisors to to manage all client contacts and tasks transparently. Each client receives their own profile with history, files, deadlines and all relevant documents. New inquiries are sorted according to relevance and tracked specifically. Team collaboration is made easier through task distribution, comment functions and shared dashboards.

Advantages:

- Fast response times to client inquiries

- Better tracking of deadlines and tasks

- Transparency for the entire team and the office management

- Less time and information wasted through central storage

Automate client communication and accelerate processes

Efficient and well-documented communication is the backbone of a successful tax officei. With a CRM like HubSpot Tax advisors can automate all client communication and design it individually at the same time. The platform makes it possible to send recurring messages – such as reminders about missing documents, deadlines or tax dates – automatically and in a personalized manner. This means that no client is left in the dark and the team saves valuable time.

Even complex processes can be significantly accelerated through automation: For example, after receiving a new mandate, the CRM can automatically create an individual task plan, inform relevant team members and request all necessary documents. Status updates, questions or feedback can be documented centrally so that everyone in the team knows immediately what is next. This transparency not only helps with meeting deadlines, but also ensures a consistently high quality of service – regardless of who is currently working on the mandate.

Through the combination of automated communication and process control, tax advisors increase their efficiency, minimize sources of error and offer clients a modern, professional service.

Typical workflows and automations for tax advisors with HubSpot

| Workflow/Automation | Benefit for the law firm |

|---|---|

| Tenant request workflow | New requests are automatically recorded and assigned to the appropriate team member |

| Deadline management | Automated reminders for tax dates and deadlines |

| Document management | Central storage and quick access to all relevant documents |

| Client communication | Personalized emails and follow-ups without manual effort |

| Team tasks and collaboration | Task distribution, comment functions and shared dashboards |

Step-by-step: This is how tax consultants digitize their processes with HubSpot

- Free account on the HubSpot-Create platform: Register the law firm and select the appropriate data protection region.

- Import data: Transfer existing client, file and contact data into the system via CSV import.

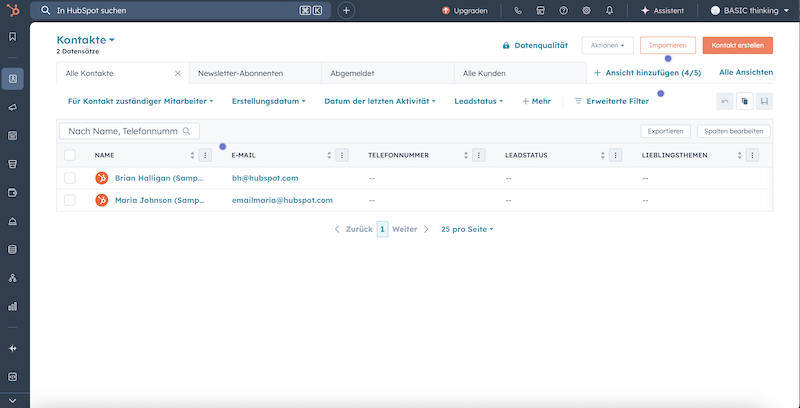

The HubSpot interface - Set up client and deadline management: Create all clients, ongoing cases and deadlines in the CRM and link them to the responsible teams.

- Enable automated workflows: Set up workflows for requests, deadlines, document management and client communication.

- Configure dashboards and reports: Create overviews for deadline status, client development and team utilization.

- GDPR and data protection ensure: Configure access rights and document consent for legally compliant processes.

Reporting and key figures: making success measurable

With the platform’s analysis tools, tax advisors keep an eye on all important key figures:

- Number and status of new client requests

- Deadline and task management

- Client development and utilization

- Team performance and open processes

- Client satisfaction and feedback

Data protection and trust: A must for the digital tax office

Tax advisors in particular have to handle confidential client data particularly sensitively. HubSpot offers GDPR-compliant hosting in European data centers, individual access rights and transparent documentation of all data processing. Consent can be recorded systematically and the deletion or anonymization of data after completion of a mandate is automated. In this way, law firms strengthen the trust of their clients and meet all legal requirements.

The HubSpot CRM and classic law firm software in comparison

Many tax firms rely on specialized solutions such as DATEV, Addison or Agenda, which were developed for accounting, tax returns and payroll. These programs offer deep integration into everyday German tax life, but are often less flexible when it comes to client management, acquisition or automated communication.

In comparison, one scores points CRM like HubSpot’s with a modern, intuitive interface, versatile automation features and strong digital client communication capabilities. The platform can be connected to email, calendar and – via integrations – also to DATEV or other systems.

While classic law firm software primarily maps the technical processes, HubSpot complements client management, acquisition and task management – and can thus significantly increase productivity and service quality.

FAQ: CRM for tax advisors – the most important questions

Is HubSpot suitable for small and large tax firms?

Yes, the platform is scalable and adapts to any business model.

Can I connect HubSpot with DATEV or accounting tools?

The solution offers numerous integrations to common tools and systems.

How does automation help in everyday practice?

Workflows save time, prevent errors and ensure consistently high service quality.

How secure is my client data?

HubSpot complies with the GDPR and offers European data centers for data protection-conscious law firms.

How quickly can I start?

The setup usually only takes a few hours. The first automations and dashboards are quickly available.

Conclusion: CRM as a success factor for tax advisors in the digital age

A CRM like the platform from HubSpot makes client management, deadline control and collaboration for tax advisors more modern, transparent and efficient. With individual workflows, real-time reporting and seamless integration, law firms not only win more clients – they also offer better service and stand out in the market.

Try HubSpot for free for your law firm now

The article CRM for tax advisors: optimizing client management, deadline control and digital collaboration appeared first on BASIC thinking. Follow us too Google News and Flipboard or subscribe to our newsletter UPDATE.

As a Tech Industry expert, I believe that implementing a CRM system for tax advisors can greatly optimize client management, deadline control, and digital collaboration. By having a centralized platform to store client information, track deadlines, and facilitate collaboration between team members, tax advisors can streamline their workflow and improve overall efficiency.

CRM systems can help tax advisors keep track of important client details, such as contact information, filing deadlines, and specific tax needs. This allows for better organization and personalized service for each client, ultimately leading to increased client satisfaction and retention.

Additionally, deadline control is crucial for tax advisors to ensure that all filings are completed accurately and on time. A CRM system can provide reminders and alerts for upcoming deadlines, helping to prevent any potential errors or late filings.

Furthermore, digital collaboration features in a CRM system can facilitate communication and file sharing among team members, even if they are working remotely. This can improve efficiency and productivity, as team members can easily access and update client information in real-time.

Overall, implementing a CRM system for tax advisors can help optimize client management, improve deadline control, and enhance digital collaboration within the firm. It is a valuable tool that can help tax advisors stay organized, efficient, and ultimately provide better service to their clients.

Credits