The article CRM for insurance agencies: automating existing customer care and new customer acquisition first appeared in the online magazine BASIC thinking. With our newsletter UPDATE you can start the day well informed every morning.

Now more than ever, insurance agencies must respond quickly, transparently and personally to customer requests. The maintenance of existing customers, the structured acquisition of new customers and the management of contracts and consulting documents require efficient digital processes. A CRM like HubSpot helps agencies to centrally control all customer contacts, offers and service processes – for more overview, better advice and sustainable customer loyalty.

What a CRM has to do for insurance agencies

A modern CRM system for insurance agencies should offer the following core functions:

- Central customer and contract management: All customer data, policies, advisory documents and communication processes are clearly stored in one place.

- Automated acquisition and offer processes: New leads are automatically captured, qualified and assigned to the right consultant. Offers and follow-up campaigns are structured and comprehensible.

- Campaign and cross-selling management: Target group segmentation, personalized mailings and automated campaigns help to increase cross-selling potential and address customers individually.

- Appointment and task management: Consultation appointments, contract extensions and important deadlines are planned and monitored centrally.

- GDPR compliance: Data protection, consent management and access rights are documented in a legally secure manner.

Practical example: This is how HubSpot supports an insurance agency in everyday life

Initial situation

A medium-sized agency manages hundreds of existing customers and receives new inquiries every day via various channels. The tracking of offers and the maintenance of contract data has so far been carried out using various tools and a lot of manual work.

Solution with HubSpot

- All customer contacts, contracts and consultation protocols are maintained centrally in the CRM.

- New leads are automatically captured, segmented and assigned to the right consultants.

- Offer tracking and follow-up actions are automated, and reminders about contract extensions are sent in a timely manner.

- Customers receive personalized information about suitable additional insurance or service offers.

- All activities are documented in accordance with GDPR and can be traced at any time.

Result

- The closing rate for new customers increases noticeably.

- Existing customers regularly receive relevant information and service offers.

- The agency saves time through automated workflows and can concentrate more on consulting.

Digital customer loyalty and personalized communication: This is how insurance agencies stay in touch

The expectations of insurance customers have changed fundamentally in recent years. You not only expect professional, competent advice, but also one proactive, personal and digital support – across the entire life cycle of your contracts. A CRM like HubSpot enables insurance agencies to specifically strengthen customer loyalty and raise communication to a new level.

With the platform, agencies can do anything Store customer information, contract data and communication histories centrally and evaluate. On this basis, personalized campaigns and service information can be sent automatically – such as reminders about contract extensions, information about new products or targeted cross-selling offers. Customers receive exactly the information that suits their current life situation and their insurance needs.

In addition, HubSpot helps agencies automatically recognize important events such as birthdays, anniversaries or claims and use them for individual contact. This not only strengthens them emotional connection, but also significantly increases satisfaction and recommendation rates. Agencies can continually measure and specifically improve service quality through feedback surveys following consultations or claims settlements.

Digital communication can be expanded to various channels: email, SMS, messenger or even personalized landing pages. All interactions are documented in the CRM so that every consultant can see at any time when and how the customer was last contacted. This ensures a consistent approach and prevents duplicate or contradictory communication.

Overall, with a modern CRM system, insurance agencies gain the opportunity to sustainably maintain customer relationships, take advantage of opportunities for additional business and position themselves as a digital, customer-oriented partner in the market.

Practical example: IDEAL Vorsorge GmbH

Initial situation

The IDEAL Vorsorge GmbHpart of the IDEAL insurance group, serves around 69,000 customers and wanted to modernize its processes for digital new customer acquisition, portfolio marketing and commercial insurance. Previously, there was no central CRM that integrated all customer interactions – before, during and after the closing process. The existing systems were primarily designed for contract management, not customer management.

Solution with HubSpot

With HubSpot started IDEAL Vorsorge two lead generation campaigns:

- A campaign to generate leads and contracts was set up for the digital product “IDEAL UniversalLife”.

- In parallel there was one A/B testing carried out with a less complex product (funeral insurance).

- The agency used HubSpot for Performance marketingran Google and Facebook campaigns and was able to automatically capture, segment and assign leads to the right consultants.

- Offer tracking, follow-ups and contract renewal reminders ran via automated workflows.

Results

- 10x faster landing page creation

- 50 percent faster response time to leads

- 75 percent more leads

- The agency was able to focus more on consulting and cross-selling as many processes were automated.

- All activities and customer data are now central and Documented in accordance with GDPR.

Conclusion

IDEAL Vorsorge uses HubSpot to digital acquisitionpersonalized communication and existing customer care efficiently and transparently – just like in the ideal image of a modern insurance CRM for insurance agencies you described.

Typical workflows and automations for insurance agencies with HubSpot

| Workflow/Automation | Benefit for the agency |

|---|---|

| Lead capture and qualification | New inquiries are automatically recorded, evaluated and handed over to the appropriate consultant |

| Offer management | Offers are created, sent and tracked directly in the CRM |

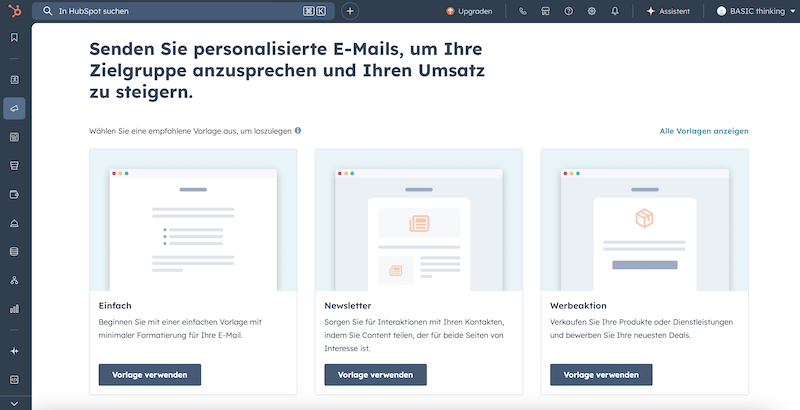

| Campaign management | Automated mailings and cross-selling campaigns for different target groups |

| Contract renewal workflow | Reminders of deadlines and extensions are sent automatically |

| Reporting & Dashboards | All key figures for leads, sales and existing customers at a glance |

Step-by-step: This is how insurance agencies digitize their processes with HubSpot

- Account on the HubSpot-Create platform: Register the agency and choose the appropriate data protection region.

- Import data: Transfer existing customer, contract and contact data into the system via CSV import.

- Set up lead and offer management: Define workflows for acquisition, offers and follow-up.

- Activate campaign and cross-selling processes: Segment target groups and set up automated mailings.

- Set up appointment and task management: Plan consultation appointments and contract extensions centrally in the CRM.

- Configure dashboards and reports: Keep an eye on leads, closing rates, utilization and customer retention.

- GDPR and data protection ensure: Configure access rights and document consent for legally compliant processes.

Software comparison: HubSpot CRM vs. AMS for insurance agencies

Many insurance agencies use industry-specific systems such as AMS (Agency Management System), which is specifically tailored to the insurance industry. AMS offers features like Contract management, commission accounting, claims processing and interfaces with insurers. It is ideal for handling specialist processes and integrating with insurance companies.

HubSpot, on the other hand, shines with a modern, intuitive interface, powerful automations and excellent options for Acquisition, campaign management and digital customer communication. The platform is particularly suitable for agencies that want to make their existing customer care and new customer acquisition more structured, transparent and digital. HubSpot CRM can be connected to AMS and other industry tools via integrations.

Conclusion: AMS maps the core technical processes, while HubSpot CRM takes communication, acquisition and relationship management to a new level. The combination of both systems offers insurance agencies maximum efficiency and future security.

Reporting and key figures: making success measurable

- With the platform’s analysis tools, agencies can keep an eye on all important key figures:

- Number and status of new leads

- Completion rates and offer status

- Campaign performance and cross-selling success

- Customer satisfaction and feedback

- Contract renewal and service quota

Dashboards help to identify weak points and specifically optimize processes.

Data protection and trust: A must for insurance agencies

Especially in the insurance sector, the trustworthy handling of sensitive customer data is essential. HubSpot offers GDPR-compliant hosting in European data centersindividual access rights and transparent documentation of all data processing. Consent can be recorded systematically and the deletion or anonymization of data after the end of the contract is automated. In this way, agencies strengthen the trust of their customers and meet all legal requirements.

FAQ: CRM for insurance agencies – the most important questions

Is HubSpot suitable for small and large insurance agencies?

Yes, the platform is scalable and adapts to any business model.

Can I connect HubSpot to AMS or other industry tools?

The solution offers numerous integrations to common tools and systems.

How does automation help in everyday life?

Workflows save time, prevent errors and ensure consistently high service quality.

How secure is my customer data?

HubSpot is GDPR compliant and offers European data centers for privacy-conscious agencies.

How quickly can I start?

The setup usually only takes a few hours. The first automations and dashboards are quickly available.

Conclusion: CRM as a success factor for insurance agencies

A CRM like the platform from HubSpot makes existing customer care and new customer acquisition for insurance agencies more modern, transparent and successful. With individual workflows, real-time reporting and seamless integration, agencies not only win more deals – they also offer better service and stand out in the market.

The article CRM for insurance agencies: automating existing customer care and new customer acquisition appeared first on BASIC thinking. Follow us too Google News and Flipboard or subscribe to our newsletter UPDATE.

As a Tech Industry expert, I believe that implementing a Customer Relationship Management (CRM) system for insurance agencies is crucial for automating existing customer care and new customer acquisition. CRM software can streamline processes, improve efficiency, and enhance customer satisfaction.

Automating existing customer care through a CRM system allows insurance agencies to provide personalized and timely service to their clients. By tracking customer interactions, preferences, and history, agents can easily access relevant information and tailor their communication and offerings accordingly. This not only improves customer satisfaction but also helps in retaining existing clients and increasing their lifetime value.

Additionally, a CRM system can also help in new customer acquisition by managing leads, tracking sales opportunities, and analyzing customer data. By automating lead generation, follow-ups, and nurturing, insurance agencies can efficiently convert prospects into customers. The system can also provide insights into customer behavior and preferences, enabling agencies to target the right audience with relevant marketing campaigns.

Overall, CRM for insurance agencies can revolutionize customer care and acquisition processes by leveraging technology to streamline operations, improve efficiency, and enhance customer relationships. It is a valuable tool for staying competitive in the ever-evolving insurance industry and should be considered as a strategic investment for growth and success.

Credits